Member Insights

Open APIs and AI powering fraud defense in modern banking

Shuba Sridhar, Vice President - Strategic Initiatives at Torry Harris Integration Solutions, discusses how CSP and banking collaboration powered by Open APIs and agentic AI closes fraud visibility gaps and enables faster, more accurate detection across channels.

Open APIs and AI powering fraud defense in modern banking

The expansion of 5G and always-on digital financial services has increased exposure across telecom and banking channels. Fraud groups now operate with greater sophistication, using SIM-swap attacks, caller-ID spoofing, smishing, and device-layer compromise to infiltrate telecom networks before moving downstream into banking systems. In 2024, the FTC reported USD 12.5 billion in fraud losses, while Communication Service Providers (CSPs) faced USD 38.95 billion in global fraud losses according to the CFCA.

Traditional controls - static rules, siloed datasets, and manual reviews cannot counter fast-moving attacks such as Authorized Push-Payment (APP) fraud, synthetic identities, and account takeovers. Institutions need coordinated intelligence: secure Open APIs and AI-driven agents that interpret CSP and banking signals in real time. This model strengthens bank risk management while enabling CSPs to monetize governed, intelligence-led services.

CSP–banking synergies

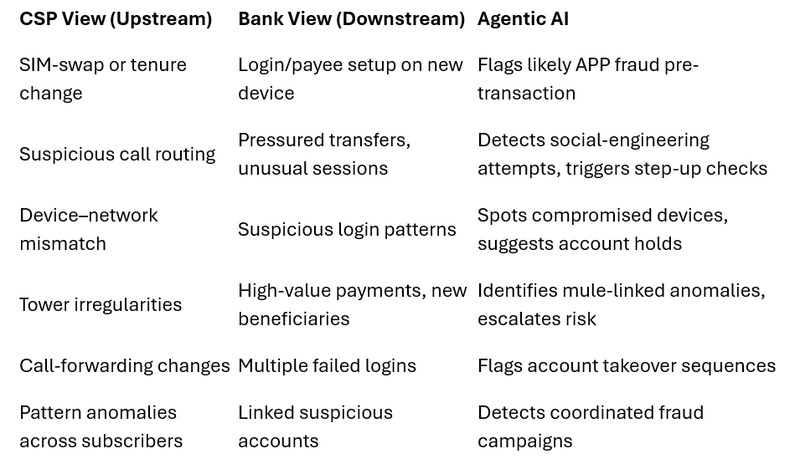

CSPs and banks hold complementary intelligence. CSPs surface upstream indicators - device movement, network integrity, routing anomalies, while banks understand payment patterns, behavioral risk, and customer intent. Combining these perspectives produces a more contextual view of user activity across the customer journey.

This collaboration strengthens identity assurance, authentication, and dispute reduction. Its greatest value lies in fraud detection, where cross-industry signal sharing closes long-standing visibility gaps

- CSPs flag upstream anomalies: SIM-swap attempts, sudden device changes, call-routing patterns, cell-tower irregularities.

- Banks detect downstream shifts: unusual payee setup, high-risk transfers, authentication friction, compromised account behavior.

When these signals flow through secure Open APIs and are interpreted by AI agents, they form a unified risk-intelligence layer that identifies fraud earlier and more accurately, reducing both false positives and missed threats.

A recent UK industry pilot demonstrated this impact: Vodafone’s network-level signals, integrated into a major bank’s workflows, helped reduce APP fraud by ~30% within three months, underscoring how quickly shared intelligence improves outcomes.

Agentic AI for CSP–bank fraud defense

Agentic AI acts as a real-time decisioning layer that continuously interprets CSP and banking signals to detect anomalies, update risk scores, and recommend targeted interventions, helping:

- Identify early signs of compromise across channels

- Escalate unusual session behavior or pressured transactions

- Trigger step-up authentication or device-integrity checks

- Correlate multi-subscriber anomalies to detect coordinated campaigns

While results hinge on governance, data quality, and integration maturity, Agentic AI drives earlier, more consistent detection - critical for threats that evolve within seconds.

Intelligent, end-to-end defense

How Open APIs close the fraud visibility gap

Open APIs provide a structured, governed framework that links CSP network-event streams, banking systems, and fraud analytics platforms. They:

- Transform raw telecom data into interpretable, contextual attributes

- Support scalable ingest of new event types without re-engineering core systems

- Standardize SIM-change, device-integrity, routing, and location signals

- Embed CSP insights directly into bank authentication flows and transaction-risk models

High-priority use cases enabled by Open APIs:

- Faster rollout of coordinated fraud controls through shared, governed API layers

- Interoperable fraud-signal exchange using consistent data models

- Stronger authentication and real-time scoring by blending network and behavioral context

- Lower false positives through richer, contextual risk inputs

- Quicker investigations via API-triggered alerts integrated into bank workflows

The monetization opportunity for CSPs

As data exchange becomes more structured, CSPs can convert network intelligence into governed, permissioned data services that strengthen digital trust. Signals such as device-integrity status, SIM-change recency, and routing behavior can be offered as API-based risk checks or anomaly alerts consumed by banks, insurers, fintechs, and digital commerce platforms.

These services can be priced on usage or subscription, creating new revenue streams while improving fraud prevention. Strong governance and transparent data practices are essential for CSPs to evolve from connectivity providers to trusted intelligence partners.

Insights from TM Forum’s Moonshot Catalyst

TM Forum’s 2024 Moonshot Catalyst co-developed by multiple TM Forum member organizations, offers an early view of how emerging cross-industry capabilities could operate at scale.

The catalyst demonstrated how telecom intelligence, banking risk data, and AI agents can operate within a shared, real-time decisioning framework. A virtual agent combined CSP signals - device identity, SIM-tenure changes, call forwarding, movement patterns - with bank transaction and behavioral data to detect high-risk activity earlier.

Early performance indicators showed potential for:

- 20-40% faster case resolution

- 15-30% fraud-loss reduction

- 15-25% lower operational costs

The initiative also outlined what it takes to scale: standardized APIs, aligned data models, strong consent mechanisms, and governance-led operating models. The architecture applies across sectors such as fintech, insurance, and e-commerce.

The shift toward collaborative risk intelligence

Fraud defense is moving from isolated controls to ecosystem-level intelligence. Institutions that adopt shared governance, coordinated response playbooks, and open-standards-based signal exchange will set the next performance benchmarks.

While fraud is the immediate use case, the same architecture unlocks broader possibilities: digital-trust products, shared services, and cross-industry revenue models. In a hyperconnected economy, organizations that coordinate intelligence with partners will be better positioned to innovate, reduce risk, and build long-term resilience.