Member Insights

From network owner to platform orchestrator: what wholesale broadband marketplace unlocks

Shuba Sridhar, Vice President - Strategic Initiatives at Torry Harris Integration Solutions, discusses how the wholesale broadband marketplace model empowers providers to unlock new revenue streams, accelerate partner growth, and shift from capacity sales to ecosystem value creation.

From network owner to platform orchestrator: what wholesale broadband marketplace unlocks

Key takeaways:

● The marketplace model empowers wholesale broadband operators to modernize their operational and commercial systems. Catalog agility, real-time settlement, and partner onboarding automation are the new pillars of competitive differentiation.

● Implementing standard APIs for service qualification, ordering, and inventory management accounts for a small portion of the overall effort. The remaining work involves operationalizing the established APIs through commercial governance, revenue-sharing models, and ecosystem management at scale.

● Sustainability comes from ecosystem economics, not connectivity economics. Growth will now depend on how fast providers can co-create value, not just sell individual capacity.

Wholesale broadband providers are facing a dilemma. While the demand for high-speed broadband connectivity has surpassed expectations, the return on investment and average revenue per user continue to stay stubbornly flat. Breaking free from this cycle of intense margin pressure involves moving to an ecosystem-driven approach that facilitates value creation.

The future of broadband relies on much more than the classic capacity sale. The focus has shifted to building a digital marketplace ecosystem that creates multiple revenue streams. The shift has already begun, with Gartner predicting that by 2028, 60% of tier 1 Communications Service Providers (CSPs) will have digital marketplaces to serve B2B customers, up from only 25% today. This trend is also seen across the economy, where digital marketplaces account for 10-20% of total revenues for over 65% of companies in North America and Europe..

However, bottlenecks exist in moving to this model. Even today, regional wholesale broadband operators are negotiating contracts individually with each partner network operator to deliver multi-site enterprise connectivity. They rely on disparate order management systems and manual processes, which extends the fulfilment timeline to weeks or even months. On the other hand, a digital marketplace allows enterprises to browse, compare, and bundle connectivity services from various providers through standardized APIs, shortening setup times to hours or minutes.

Marketplaces, or orchestration platforms, help generate multiple revenue streams to support enduring business expansion for all participants:

● Wholesale broadband providers can add new revenue streams through transaction fees, API monetization, and dynamic pricing when they list their capacity and services.

● Internet service providers (ISP) gain immediate access to wholesale capacity, enabling them to launch services quickly and secure better pricing through streamlined contract negotiations.

● Enterprise customers can obtain customized high-speed connectivity solutions for their specific locations and bandwidth requirements through direct access or by working with their selected ISPs.

At the TM Forum Catalyst, Broadband as a Service: The future of wholesale broadband ordering: Phase II, Torry Harris showed how BaaS can be turned into a growth platform, moving from a consistent, faster sales process to unlocking new revenue models through a digital marketplace.

Maturing from capacity leasing to capability trading

A wholesale broadband marketplace is a digital environment that enables network owners, ISPs, and service aggregators to publish, discover, and transact network services using open standardized interfaces. This represents a significant change from static bilateral agreements to a more dynamic marketplace where network connectivity can be consumed on demand, and even broadband becomes part of a service economy, as opposed to simply infrastructure access.

A regional wholesaler in Norway exemplifies that even in markets with 100+ network operators, standardization will make a real difference. The company is developing a fiber broadband marketplace using TM Forum Open APIs to tackle the operational burden of wholesale broadband, where tight margins require efficiency. The leadership team realizes that standardization is crucial to allowing the marketplace to operate on a profitable basis and grow.

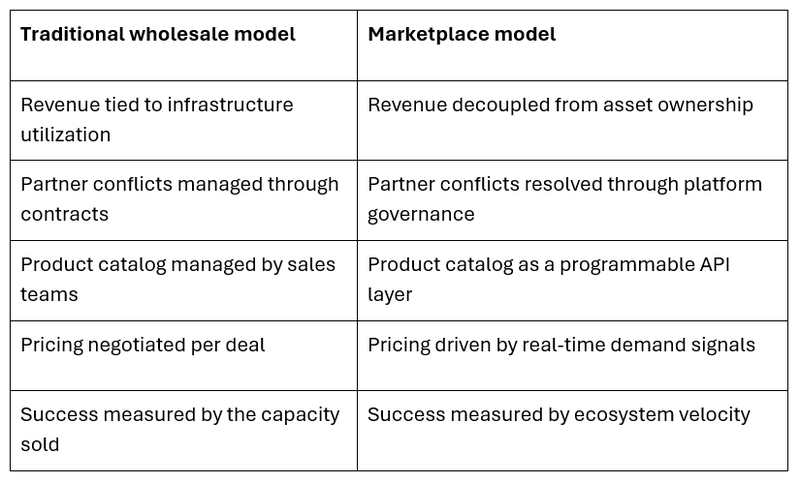

Key aspects of the wholesale model transformation

The transition to a platform-based model is transforming B2B commerce across virtually every industry vertical. For wholesale broadband providers, the question is no longer about the rationale behind this model, but how they can operationalize it.

Marketplace-backed revenue streams for wholesale providers

The worldwide market for wholesale telecom services is expected to be worth $512.85 billion in 2025, and wholesale broadband providers are in a position to gain additional revenue from new types of service delivery using a marketplace-enabled approach. This model enables wholesale broadband providers to unleash four distinct revenue streams beyond traditional capacity leasing.

- Monetizing the API economy: Transitioning from physical circuit sales to monetizing API calls opens recurring digital revenue streams. By providing network functions out of the box, such as service qualification, dynamic bandwidth allocation, and real-time monitoring of service performance, as premium APIs, operators can earn revenue independent of the physical infrastructure. An API-first architecture can provide up to a 50% growth opportunity in partner-based sales.

- Ecosystem-driven service bundling: Marketplaces enable wholesale providers to bundle core connectivity with a suite of complementary B2B services, such as managed Customer Premises Equipment (CPE), SD-WAN capabilities, and network security. This development means all CSP and ISP customers can create integrated offers without needing to build every component from scratch. Additionally, working with specialized vendors enables wholesale providers to enhance a desirable and differentiated service bundle, allowing their customers to provide premium pricing models while reducing time-to-market.

- Accelerated partner ecosystem growth: API-based, standardized platforms can shorten partner onboarding time from months to days. This allows wholesale broadband providers the ability to penetrate their addressable market faster, improve network utilization, and accelerate the return on investment from fiber. Wholesale providers understand that the value of their marketplaces is a function of their partner ecosystems' diversity and scale—more partners (CSPs, ISPs, service aggregators, etc.) mean greater network effects and improved revenue potential.

- Data and insights as a service: Wholesale providers can achieve a return on their investment in marketplace-created data, similar to published usage patterns, the intersection of regional demand cycles, and benchmarks on service quality. By packaging de-identified data, the provider can turn insights into market intelligence for expansion, demand forecast tools for capacity providers, or competitive positioning tools for customers, all of which actually monetize the operational data generated.

Market and regulatory forces at play

Three dominant forces are coming together to allow wholesale broadband providers to establish marketplace ecosystems that cater to telcos, CSPs, and ISPs.

First, open standards have matured, including APIs and TM Forum architectural specifications, and allow for seamless interoperability between wholesale providers and their service-provider customers. Leading analysts underscore that TM Forum Open APIs have become critical for wholesale providers as they look to standardize how they enable telcos and other service providers to leverage their network capabilities and reduce ongoing integration burdens across the marketplace ecosystem.

Second, modular digital architectures, including the Open Digital Architecture (ODA), permit wholesale providers to dynamically compose services and give their telco and ISP customers the ability to ingest new service offerings quickly and without customized development.

Third, regulatory shifts toward open access provide new opportunities for wholesale providers to broaden their addressable customer base by providing multi-service-provider access to their networks through standardized marketplace access, while fostering competition and innovation in the retail layer.

Compete on cost or orchestrate ecosystem value

The shift from wholesale manual processes to digital marketplaces is broadband’s most significant inflection point. Standardization via Open APIs and modular architectures provides the groundwork, but broadband's real evolution occurs when providers consider connectivity as a programmable, tradable asset in an open ecosystem.

There is a strategic turning point for wholesale broadband providers. Those that continue to focus on network ownership alone will be competing over price. However, providers that embrace a marketplace model will be competing over ecosystem value in real-time services, partners, and intelligence.

In a connected economy, speed to collaborate will determine who will succeed. Providers that evolve from network operators into platform orchestrators will win. That is the real next frontier for wholesale broadband.